Following In Zynga's Footsteps | Candy Crush's IPO Rated As The 2nd Worst Performing Market Debut

Game developer, King Digital Entertainment, has decided to test investors' faith two days ago and announced a pricing for their initial public offering (IPO) at $7 billion valuation. Considering that in February alone, the popular Candy Crush Saga boasted around 97 million users and over 1 billion daily game-plays, they simply could not resist the temptation of going public.

In the meantime, King turned almost $600 million profit last year underlying the tremendous success of Candy Crush Saga, an addictive game that, according to App Annie, was the top-grossing franchise in the US for iOS devices. According to an amended prospectus filed Wednesday morning, King intended to transform those billions of games played into billions of dollars.

Another example of history repeating

Given King's 10 year troublesome journey, you can say that the IPO is a normal step. The 22.2 million shares were listed on the New York Stock Exchange with prices varying from $21 to $24 per stock. With a midpoint of $22.5 per share, the deal was expected to bring early investors $150 million and around $344 million for King.

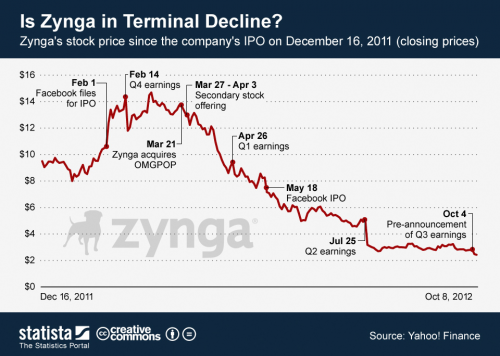

While everything seemed to be working well for King, I'm not convinced that the developer was aware of the risks involved. Even though they argue that they didn't following the same path as Zynga, the truth is that they're attempting to milk a category of games that appeal mostly to a relatively small group of dedicated casual gamers.

Wednesday at noon, King was trading around $20.05 per share, lower than the minimum $21 they estimated. On Thursday, the stock traded in the red throughout the entire morning and hit a low of $19.08 by closing time. Frankly, this is a textbook example of history repeating.

The signs were all there, but King chooses not to see them

After Zynga's tremendous failure, most companies decided to stay off public markets. As Zynga's example teaches us, you can't go public even with a huge hit like Candy Crush Saga, unless you have an equally viral game in the makings. As you probably know, the successful and highly popular Farmville has now faded from public memory.

In the light of these facts, I believe it's clear why you shouldn't risk it all when the significant rapid growth comes from a single game. Sure, most of the people I know played Candy Crush Saga obsessively. However, even they got bored with the game after a while. Since you can't keep a casual gaming format compelling and engaging forever, it's wiser to release your next big hit ready before going public.